We understand circumstances change. We realize you may find yourself unable to make a mortgage payment each month, service other secured & unsecured debt along with normal living expenses. The availability of positive cash flow is key.

We understand circumstances change. We realize you may find yourself unable to make a mortgage payment each month, service other secured & unsecured debt along with normal living expenses. The availability of positive cash flow is key.

We’re here to help you through difficult times.

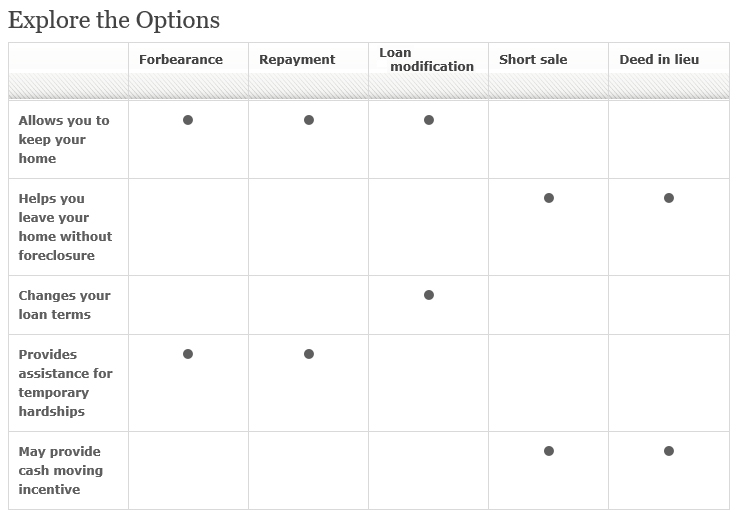

Below are the various options that can help you resolve your situation & provide peace of mind. Knowing which option to choose:

- depends on a deeper / confidential review of your financial situation & documentation,

- after which we engage in a candid discussion of the strengths / weaknesses of what we find, &

- then take decisive & prompt action.

A growing trend sadly involves property foreclosures in the 55+ age group where there is positive equity – that is, where the loan / mortgage debt is less than the fair market value of the property. I am expert in and designated as a Senior Real Estate Specialist for those in the 55+ age group.

Where there’s positive equity, regardless of your age, your best options may include:

- CURING the defaulting mortgage amount (see below) – this generally is a payment to bring current all past due mortgage payments, impounds (if applicable) for taxes & insurance, late fees, foreclosure fees, etc.

- Asking the lender to some other sort of relief such as a forbearance, repayment plan, or loan modification. Lenders may demand financial information from you before granting any of these options.

- IT MIGHT BE THE RIGHT TIME TO SELL. The events that lead up to mortgage default justify considering whether now is the right time to sell the property in order to extract the equity that can then be used to ‘right-size’ – that is, for instance, sell a property you have out grown for something that better fits your lifestyle and is more affordable.

My TEAM of real estate experts will assess your property value, physical condition, and more to make recommendations. It is not always wise to cure a loan just because you can; the same situation that lead up to the default may recur & at a time you are in a less well-positioned place in life to contend with the default and lender pressure!

Mortgage Modification

Sample: Loan-MOD-Process

This option permanently changes your mortgage loan so your payments or terms of your loan are more affordable.

Generally, you may be able to modify your home loan under one of the programs if all of the following apply:

- You’re experiencing a financial hardship-reduction in income or an increase in mortgage payment

- You’re 60 or more days behind on your mortgage payments

- The property is a 1- to 4-unit house, condo or manufactured home

- ALL borrowers on your loan agree to participate

- You permit access to the interior of the property for an appraisal or inspection, if required

- You provide all financial information requested, and show that your income is consistent enough to make the modified monthly payments

If ineligible for a modification—and unable to resolve your difficulty through other programs—you may need to consider options that involve leaving your home »

“Short” Selling

Sample: Short-Sale-Process

If you want to sell your house but it’s worth less than the amount remaining on the mortgage, this may allow you to sell your house & settle your mortgage debt. By completing a short sale ..

- you sell the home and pay off a portion of your principal balance,

- you avoid allowing your house to go through foreclosure,

- you avoid eviction and your house won’t be sold at a public sale or auction, and

- you could qualify for financial assistance to help with relocation costs.

- You may significantly mitigate legal / tax liability exposures.

You may be eligible if ALL met:

Deed In Lieu

Sample: Deed-in-Lieu-Process

If you are unable to sell the home, this program allows you to release the property and transfer ownership to the investor / lender . You may be eligible to release the property if you meet all of the following requirements:

- Your mortgage is a first lien, primary mortgage on the property.

- Your account is in default or imminent default.

- You’ve demonstrated a hardship.

- The property must have clear title, meaning there can be no other liens or payments owed before the property can be released to the lender.

- The home must be in livable condition, passed a property inspection and is not a condemned property.

It allows you to move out of the home without going through foreclosure. In some cases, relocation assistance may be available.

» NOTE: If there are ANY liens on the title, such as one or more junior loans or a IRS or FTB tax lien or money judgment or the like, a Deed In Lieu is NOT possible absent cooperation from the other lienholders releasing their position.

Repayment Plan

This program allows you to pay back the past-due amount with your regular monthly payments over an extended period of time. This means your monthly payments will be higher than normal as part of a repayment plan. An initial down payment (or contribution) may also be required to get started. It allows you time to catch up on past-due payments without having to come up with the total amount due at once.

You may be eligible for a repayment plan if you meet all of the following requirements:

- Your account is in default or imminent default.

- Your account is less than or equal to 90 days past due.

- You agree to continue making your monthly payments according to the terms of the mortgage at the end of the plan.

Forbearance Plan

Here you may make reduced mortgage payments or stop making payments for a specific period of time. This option gives you time to improve your financial situation. There are two types of assistance available:

Forbearance

You may be eligible for forbearance if you meet all of the following requirements:

- Your account is in default or imminent default.

- You’ve demonstrated a hardship.

Unemployment Forbearance

This program offers you temporary financial relief if you are unemployed by reducing your monthly mortgage payments while you look for a new job.

Reinstatement / Cure

» Lender websites / mortgage assistance: