Hospitality, Retail, Office, Industrial, Special Use Properties

Over the past several months I have represented commercial properties exceeding $250,000,000 in value and negotiated loans exceeding $200,000,000. EVERY FILE I submitted for lender consideration was reviewed, approved, and funded!

Whether you are looking for an acquisition loan, a refinance, a bridge loan, SBA financing, I am immediately ready to assess your particular debt requirements! Importantly, my representation is comprehensive – from real estate, to legal, to tax, and common sense. I come to the table prepared armed with vast resources that will purposefully help you make informed decisions and, where possible, underpin the success of your business through positive cash flow. I look for metrics that mitigate expenses while enhancing revenue streams.

You too may have maturing loans or ones that are resetting. If so, NOW is the time to have me review your property and ![]() personal financials, run a DCSR analysis, supported by property valuation, analytics, and metrics that best position your property for lender / underwriting consideration all of which makes loan approval more rather than less likely. I stay engaged from start to finish / loan funding!

personal financials, run a DCSR analysis, supported by property valuation, analytics, and metrics that best position your property for lender / underwriting consideration all of which makes loan approval more rather than less likely. I stay engaged from start to finish / loan funding!

After my analysis and candid conversation, we may advance refinance efforts or you might decide to list your property with me for sale.

As a 35+ year Broker, I would be honored to represent you in the sale of your commercial investment property in an outright sale and in the purchases of a new investment in a 1031 Exchange (read below). Representing clients in my dual Broker / Attorney capacities is a distinct negotiating advantage for you not to mention your immediate access to legal and tax advice!

REFINANCE

Is your loan resetting or is it maturing?

Let’s explore your best options!

Want a competitive advantage getting your loan? Here’s how.

Remember, because I am your attorney, all conversations, documents, everything is confidential attorney-client work product.

Simply reach out to me HERE for a no obligation, no cost, 3-STEP (see below) assessment of your investment property!

We will candidly discuss your objectives, timing, and needed documentation. This is followed by a quick but precise debt analysis that may lead to a formalized engagement agreement.

Simply reach out to me HERE for a no obligation, no cost, discussion of what you are interested in selling, buying, price requirements, financials, and timing.

If you are selling, we will have a candid discussion about the property you are selling, shape the right listing price based on financials, I will prepare a presentation package that can be shared online (i.e., CREXI), we will create a war room of review documents, etc.

Selling and/or Buying, we will help you effectuate a 1031 Exchange. The main requirements for a 1031 exchange are: (1) must purchase another “like-kind” investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any “boot”); (4) must be the same title holder and taxpayer; (5) must identify new property within 45 days; and (6) must purchase new property within 180 days.

If you are buying, I will conduct a preliminary review of what’s on the market that fits your financial and other needs so that we can begin the process of narrowing those properties you are interested in advancing to a Letter of Interest to start purchase negotiations.

You hold a competitive advantage in every transaction with my 30+ years seasoned expertise coupled with my attorney licensure and acumen that will carefully guide you through escrow / title, transactional documentation, and due dilgence. My personal involvement ensures you are actively participatory in every step of the important decisions that surround your investment in commercial real estate.

Loans – Acquisition, SBA, Refinance, Bridge, Construction

No cost. No commitment.

Just a fair in depth financial assessment

to help you decide “what next” and "when".

Having refinanced many properties over the past years, I understand what you have endured. Many of my clients survived the Pandemic and economic downturn connected to it. But there are still issues swirling in the economy with inflation, a Federal Reserve that seems to be overcooking its response to lag data, challenges with finding and keeping employees, and global tensions all of which are projected by many economists to last beyond 2024.

These concerns affect you particularly if existing business debt is subject to interest rate reset or maturity.

That is where I can assist. With no initial cost or obligation to you, I invite confidential conversation such as:

- Using refinancing as a tool to

- reposition your investment,

- improve cash flow,

- consolidate debt,

- sourcing funds for needed PIP or capital improvements,

- sourcing “cash out” for operational reserves and other lender-approved purposes.

So .. let's address these questions:

- When does your existing debt mature forcing you to refinance?

- When do the prepayment penalties end or at least reduce?

- How can acting today give you the clarity of thought to focus on increasing your business revenues?

NOW is the time to re-evaluate your debt structure / terms / pricing before inflation locks you into higher interest rates. Be proactive to protect your positive cash flow!!

- All data is carefully / confidentially reviewed before submitting anything to lenders.

- ALL documentation, EVERY communication is confidential attorney-client work product.

- The process has become more complex, with more lender requirements, but we work to simplify & expedite.

- Lender approval is dependent on solid financials / borrower liquidity.

- Lenders' required list of needed documentation is set forth below.

Please use my secure Server that encrypts all incoming messages & financial data - avoid email.

Print List of Needed-Documents - Click on Image Below

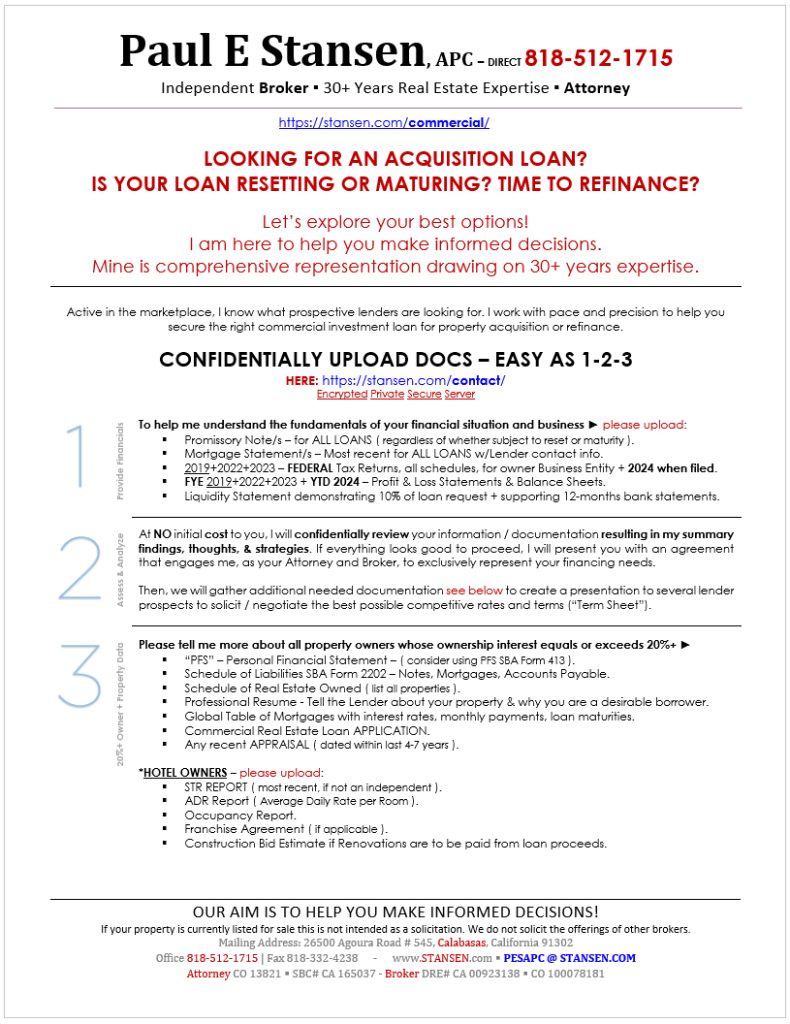

I need to understand your financial situation and business. Please upload:

- Promissory Note/s – for ALL LOANS

- Mortgage Statement/s – Most recent for ALL LOANS w/Lender contact info

- 2019+2021+2022+2023 - Complete ( FEDERAL ) Tax Returns, all schedules, for Business Entity + 2024 when filed.

- FYE 2019+2021+2022+2023 + YTD 2024 – Profit & Loss Statements & Balance Sheets.

- Liquidity Statement demonstrating 10% of loan request + supporting 12-months bank statements.

At NO initial cost to you, your information / documentation will be reviewed resulting in written findings, thoughts, & strategies.

If it appears a refinance is supported by data presented, I will present you with an exclusive representation agreement that establishes my scope of work, and which manages expectations.

Thereafter, I will gather additional needed documentation to create a presentation package that will be shared with several competing lender prospects who will bid for your business (the loan) with the best possible rates and terms.

Tell me more about the owners. From EACH 20%+ owner/s, please upload:

- PFS – Personal Financial Statement – PFS SBA Form 413

- Schedule of Liabilities SBA Form 2202 – Notes, Mortgages, Accounts Payable

- Schedule of Real Estate Owned

- Professional Resume

- Global Table of Mortgages w/interest rate, maturity

- Commercial Real Estate Loan APPLICATION

- Any recent APPRAISAL ( dated within last 4-7 years )

** HOTEL OWNERS – please upload:

- STR REPORT ( most recent if not an independent )

- ADR Report ( Average Daily Rate per Room )

- Occupancy Report

- Franchise Agreement ( if applicable )

- ANY Appraisal ( if available )

- Construction Bid Estimate if Renovations are to be paid from loan proceeds ( recently dated / signed )

Interactive Forms

** These forms originate from WFB for information gathering purposes only.

** WFB may or may not be a lender to which request will be made.

Brokerage Services – One Stop Comprehensive Representation

Broker & Attorney

Real Estate • Legal • Tax

Trusted Advisor

Beyond professionally helping with refinancing existing loans, many of my clients use me in my BROKER capacity to list / market / sell their commercial investment properties then pivot to locate and purchase replacement investment properties often in a structured “1031 exchange”. Clients leverage my legal and tax expertise throughout every transaction and representation.

As an example, I closed a 1031 exchange as described above. The downleg property sold was a hotel located in San Simeon and the replacement property purchased was a $10,100,000 retail center (Colonial Square) located in Bakersfield, California.

- I represented my clients in the purchase of the upleg property in my Broker capacity

- I negotiated the purchase money loan for more than $6,000,000

- Throughout the entire transaction, I personally represented my clients on legal and tax matters.

- I additionally negotiated the Property Management Agreement for a local firm to manage the 41,238 SF shopping center

Testimonial: Commercial Hotel Loan Broker

by Dhaval Panchal, Commercial investor of multiple properties

Paul was hired by our company to refinance a loan for one of our hotels. Paul is very:

- Smart, extremely knowledgeable in his field of work

- Responsive, picks up the phone when called or returns calls ASAP – nearly 24-7

- Organized, VERY organized!!

- Gets the job done with the least amount of stress to us.

He did such a great job on our first hotel we hired him to refinance our 2nd hotel as well. And then our 3rd Hotel!!!

Bottom line Paul gets the job done, pleasant to work with and is extremely knowledgeable as a Loan Broker/Attorney!!!

You care about your investments?

Are you interested in enhanced cash flow?

You want peace of mind?

Hire Paul!