When you consider selling any real estate, particularly your primary residence, serious concerns pivot on:

- “What is my property worth?”

- “What are my NET proceeds, after closing costs and taxes?”

- “How can I avoid legal liability – what can you do to help me?”

- “I suspect, or know, I will owe CA-FTB & IRS taxes on capital gains, but what options do I have to reduce or avoid them?”

- “Can I ‘move’ my current lower real property taxes (PROP-19) to my new home?” “How does Prop-19 work?”

It is each of these questions, individually and combined, that materially impact whether you choose to sell your home.

For those of us who have owned our homes for 15-20-or more years, the importance of crunching the numbers (property value, tax on capital gains, timing sell and purchase, etc.) and implementing go-forward strategies could not be more important!

Page Jumps

1. Prop-19 Eligibility

2. Assessing Tax on Capital Gains

As a licensed Broker & Attorney, I provide vital legal & tax advice to help clients make informed decisions.

Have you crunched your numbers to assess tax on cap gains exposure?

What are your estate tax strategies?

For a Growing Segment of Homeowners, Things are Different

Odds are your home has significantly appreciated in value over the past several years.

But the market may be leveling out in some geographic areas due to inflation and a possible looming Recession.

You may be thinking “what next and should I sell”?

Should you move unrealized profits into other assets, conduct estate planning, take other action? If you buy another personal residence, can you ‘move’ your lower tax base to your new home (Prop-19) and how can you mitigate the tax on capital gains from years of appreciation?

Ultimately, it comes down to not only what is your home worth, but how much of that (net proceeds) can you keep and what is the resulting cash flow that will guide you forward?

By 2024, one in four people in the United States will be 60 or older. People are living longer. At some point, many 55+ homeowners will sell their homes, whether it be a choice to downsize or because circumstances force them to make a move.

The logistics of preparing a family home for a sale and downsizing a lifetime’s worth of possessions can be daunting. More, the financial and tax implications of selling a home can affect that long-awaited (and much deserved) retirement or change estate planning.

Some things to keep in mind when considering a 'later-in-life' home sale:

- It’s a family affair – Although most seniors make the decision to move, their adult children or other family members sometimes help them decide whether moving is the best alternative. Involve the family in the decision!

- Legal concerns – An adult child or another family member might need authority to make legally binding decisions regarding the sale if a parent is ill or incapacitated. A durable power of attorney naming the person who will act on behalf of the sell must be done prior to the incapacity.

- Financial consequences – Selling a home can trigger significant taxation, especially if proceeds aren’t used to purchase a replacement home and tax on capital gains apply. Since every case is different, it’s best to contact a tax expert or financial advisor to determine how the sale will affect the seller financially.

I will assess your tax on capital gains exposure & Prop 19 eligibility (real property tax portability) by gathering key information that define what you can / cannot do to mitigate tax liability exposures. We will confidentially assess such facts as age, ownership vesting, purchase date, price paid, capital improvements that increase “cost basis”, confirmation that it is your primary residence for the requisite timeframes, and more.

California PROP-19 – Property Tax ‘Portability’

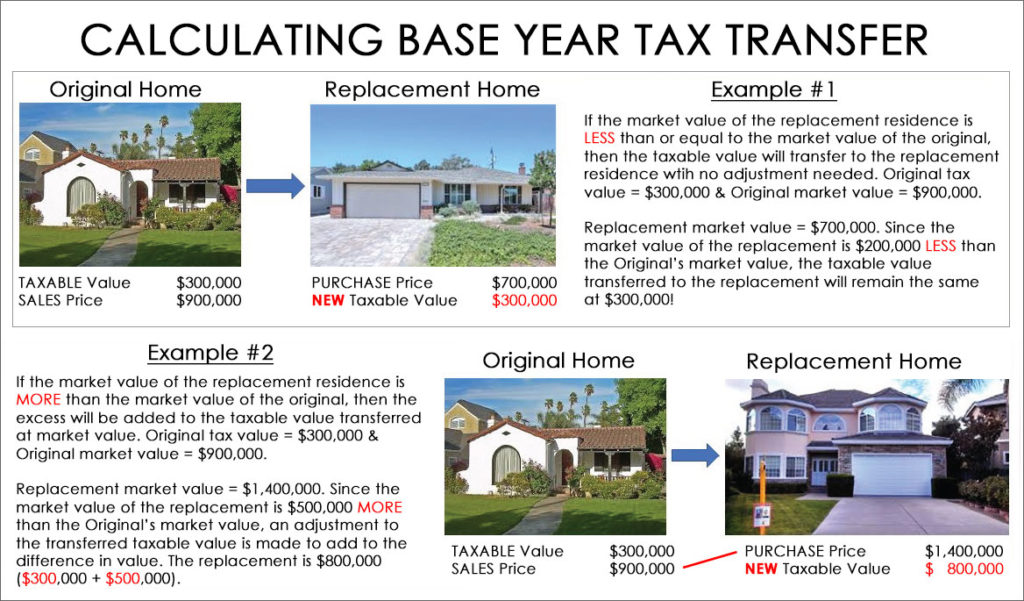

Put simply, ways you can transfer the lower real property taxes from your primary residence to replacement home.

Eligible homeowners who qualify for a Prop 19 tax base transfer include:

- Homeowners ages 55 and over

- Severely disabled homeowners

- Victims of wildfires or natural disasters

These eligible homeowners may transfer the taxable value of their primary residence to a replacement primary residence:

- Anywhere in the state – regardless of the location

- Regardless of the value of the replacement primary residence — even if it’s greater in value (with an upward adjustment in the tax basis if the replacement property is greater in value)

- Within two years of the sale of the original primary residence

- Up to three times

Eligible homeowners would consider selling to be closer to family and/or medical care, to downsize, or move to a home that better meets their needs without a property tax increase (with an adjustment upward to their tax basis if the replacement property is of greater value).

Click here to consider these Frequently Asked Questions

See other examples of how homeowners can save with Prop 19.

I will help you determine, and qualify for, eligibility which pivots off several factors:

- date you bought your property,

- confirmation of your age with documentation,

- amount paid for your primary residence,

- confirmation that it is your primary residence and that you currently reside in it,

- whether you made capital improvements that add to your “cost basis”,

- and more.

We can even assist with you prepare the filings with the County Tax Assessor’s Office to ensure your real property taxes are properly assessed.

* Note: Senate Bill 539 clarifies Prop-19 HERE Senate-Bill-539 and Property Tax Exemptions from Reassessment and Prop 19 Implementing Legislation (car.org)

* Note: Matters involving multiple properties and/or generational transfers require added scrutiny.

- Ask me - here

- Check your County Assessor’s website

- Click here to see a sample Prop 19 transfer form

At no cost to you, I will prepare the filings with the County Tax Assessor's Office to ensure your real property taxes are properly assessed.

The information that goes into this filing includes my complimentary assessment of any taxation you might incur on the capital gains (i.e., "Profits") in the sale of your residence.

Are the Profits from the Sale of Your Home Taxable?

Property appreciation -value increase- may be subject to taxation at the State and Federal levels.

Appreciation –value increase - your Profit– is great news but it comes with a potential tax on capital gains which is a particularly huge concern for an aging America. Some of that value increase could be taxed as a "Short-Term" (property held for LESS than 1 year - taxed as ordinary income) or a "Long-Term" Capital Gain (property held for MORE than 1 year - taxed based on different rate schedules) if not otherwise exempt under the Internal Revenue Code.

Ultimately, you have 3 basic options to contend with potential tax on capital gains whenever you choose to sell your home.

- Pass title at death with a stepped-up basis (capital improvements), or

- Pay tax on Capital Gains in the year of sale, or

- Defer or eliminate the tax … as much as $37,000 on every $100,000 of Capital Gains

Profit on home sale usually tax-free

Many home sellers don’t even have to report the transaction to the IRS. But if you’re one of the exceptions, knowing the rules about excluding the profit from your income can help you hold down your tax bill.

Do I have to pay taxes on the profit I made selling my home?

It depends on how long you owned and lived in the home before the sale and how much profit you made.

- If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free.

- If you are married and file a joint return, the tax-free amount doubles to $500,000.

The law lets you "exclude" this profit from your taxable income. (If you sold for a loss, though, you can't take a deduction for that loss.)

- You can use this exclusion every time you sell a primary residence, as long as you owned and lived in it for two of the five years leading up to the sale and haven't claimed the exclusion on another home in the last two years.

- If your profit exceeds the $250,000 or $500,000 limit, the excess is reported as a capital gain on Schedule D.

How do I qualify for this tax break?

There are three tests you must meet in order to treat the gain from the sale of your main home as tax-free:

- Ownership: You must have owned the home for at least two years (730 days or 24 full months) during the five years prior to the date of your sale. It doesn't have to be continuous, nor does it have to be the two years immediately preceding the sale. If you lived in a house for a decade as your primary residence, then rented it out for two years prior to the sale, for example, you would still qualify under this test.

- Use: You must have used the home you are selling as your principal residence for at least two of the five years prior to the date of sale.

- Timing: You have not excluded the gain on the sale of another home within two years prior to this sale.

If you're married and want to use the $500,000 exclusion:

- You must file a joint return.

- At least one spouse must meet the ownership requirement (owned the home for at least two years during the five years prior to the sale date).

- Both you and your spouse must have lived in the house for two of the five years leading up to the sale.

If you are considering which option best fits YOUR situation, contact me.

No cost. No commitment. Just a dialogue.

My aim is to help you make YOUR right decision.

Together, we will crunch the numbers to assess your tax exposure and find ways to mitigate your exposure.

*Note: this analysis should be done with assistance of a CPA or Attorney. Realtors cannot help as they don't have the right licensure.

If you are considering selling your property, engage me as your listing broker / attorney representative. Everyone’s situation is different. Once engaged, we will work through a review of your particular situation. My aim is to provide you with baseline information and advice so you can make informed decisions along with your CPA tax preparer.

The importance of these concerns is vital to what you do and when.

I am a 30+ year real estate Broker and Attorney licensed to provide real estate, legal, and tax advice. Compensating me for the process of determining tax on profits are most often built into listing your property for sale. In other words, with a property listed with me means there are no additional hourly or flat fees charged for my professional services. If your property is not listed for sale, there will be charges based on a written engagement agreement.

To learn whether you have a gain or loss on the sale of your home, refer to:

For general information on the sale of your home, refer to:

- IRS Publication 523: Selling Your Home.

- The IRS defines a capital improvement as a home improvement that adds market value to the home, prolongs its useful life or adapts it to new uses. Minor repairs and maintenance jobs like changing door locks, repairing a leak or fixing a broken window do not qualify as capital improvements.

- Tax Topic 701: Sale of Your Home,

- IRS Publication 551 Cost / Adjusted / Other Basis.

- Topic No. 409 Capital Gains and Losses

- Application of 3.8% Net Investment Income Tax

Tax Aspects of Home Ownership: Selling a Home

More Home Ownership Articles

Federal Tax rates on Capital Gains

2024 Long-Term Capital Gains Tax Rates

Tax Brackets (taxes due April 2025)

Tax rate |

Single |

Married filing jointly |

Married filing separately |

Head of household |

|---|---|---|---|---|

|

10% |

$0 to $11,600 |

$0 to $23,200 |

$0 to $11,600 |

$0 to $16,550 |

|

12% |

$11,601 to $47,150 |

$23,201 to $94,300 |

$11,601 to $47,150 |

$16,551 to $63,100 |

|

22% |

$47,151 to $100,525 |

$94,301 to $201,050 |

$47,151 to $100,525 |

$63,101 to $100,500 |

|

24% |

$100,526 to $191,950 |

$201,051 to $383,900 |

$100,526 to $191,950 |

$100,501 to $191,950 |

|

32% |

$191,951 to $243,725 |

$383,901 to $487,450 |

$191,951 to $243,725 |

$191,951 to $243,700 |

|

35% |

$243,726 to $609,350 |

$487,451 to $731,200 |

$243,726 to $365,600 |

$243,701 to $609,350 |

|

37% |

$609,351 or more |

$731,201 or more |

$365,601 or more |

$609,351 or more |

2025 Long-Term Capital Gains Tax Rates

Tax Brackets (taxes due April 2026)

Tax rate |

Single |

Married filing jointly |

Married filing separately |

Head of household |

|---|---|---|---|---|

|

10% |

$0 to $11,925 |

$0 to $23,850 |

$0 to $11,925 |

$0 to $17,000 |

|

12% |

$11,926 to $48,475 |

$23,851 to $96,950 |

$11,926 to $48,475 |

$17,001 to $64,850 |

|

22% |

$48,476 to $103,350 |

$96,951 to $206,700 |

$48,476 to $103,350 |

$64,851 to $103,350 |

|

24% |

$103,351 to $197,300 |

$206,701 to $394,600 |

$103,351 to $197,300 |

$103,351 to $197,300 |

|

32% |

$197,301 to $250,525 |

$394,601 to $501,050 |

$197,301 to $250,525 |

$197,301 to $250,500 |

|

35% |

$250,526 to $626,350 |

$501,051 to $751,600 |

$250,526 to $375,800 |

$250,501 to $626,350 |

|

37% |

$626,351 or more |

$751,601 or more |

$375,801 or more |

$626,351 or more |

MORE information about Tax Brackets.

MORE on Federal & California Capital Gains Tax.

Estimate / Calc Capital Gains Tax. **DISCLAIMER: Contact your CPA for specific information and advice. Calc#2.

SHORT-TERM capital gains are taxed as ordinary income according to federal income tax brackets.

Find out if the 3.8% Net Investment Income Tax applies to you

If an individual has income from investments, the individual may be subject to net investment income tax. Effective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

The statutory threshold amounts are:

- Married filing jointly — $250,000,

- Married filing separately — $125,000,

- Single or head of household — $200,000, or

- Qualifying widow(er) with a child — $250,000.

In general, net investment income includes, but is not limited to interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income.

Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes. To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax.

State Tax rates on Capital Gains

Because California does not give any tax breaks for capital gains, you could find yourself taxed at the highest marginal rate of 12.3% plus the 1% Mental Health Services tax (where income exceeds $1 MIL). This is maximum total of 13.3% in California state tax on your capital gains. It all depends on your tax bracket. Note that the calculator below is set at 12.3% and does not factor in the 1% Mental Health Services tax for those taxpayers annually earning more than $1,000,000.

Single or Married Filing Separately

1.00 %: $0-$8,544

2.00 %: $8,545-$20,255

4.00 %: $20,256-$31,969

6.00 %: $31,970-$44,377

8.00 %: $44,378-$56,085

9.30 %: $56,086-$286,492

10.3 %: $286,493-$343,788

11.3 %: $343,789-$572,980

12.3 %: $572,981-$999,999

12.3 % + 1% Mental Health Services surtax where income is $1,000,000+

Most home sellers don’t have to report the transaction to the IRS because the profit does not exceed $250,000 for single taxpayers or $500,000 for married taxpayers (§ 121 Exemption).

However, if you’re one of the exceptions, knowing the rules will help you hold down your tax bill. TurboTax addresses some of the most common topics, concerns, pivot points, & solutions:

» TurboTax – Tax Aspects of Home Ownership: Selling a Home

» TurboTax – Home Ownership Tax Tips

- Do I have to pay taxes on the profit I made selling my home?

- How do I qualify for this tax break?

- How do I qualify for a reduced exclusion?

- Deciding whether to take the exclusion

- Do I have to report the home sale on my return?

- Figuring the gain on the sale of a home

- What is the original cost of my home?

- What is the adjusted basis of my home?

- Postponed gains under the old “rollover” rules

- Converting a second home to a primary home

- IRS TOPIC 701 Sale of Your Home + Investopedia

But what if your NET sales proceeds exceed your §121 Exemption – Deciding whether or when to sell includes these basic options:

- DON’T SELL. You might choose to retain ownership regardless of whether you have outgrown your home’s size & needs and you have sufficient funds to pay maintenance and other costs. Beneficiaries will receive stepped up basis (FMV of property) on date of death.

- SELL. You might choose to sell your home for any number of reasons in which case you may be required to pay the full tax on Capital Gains in the year of sale. To mitigate your exposure, you would try to increase / adjust the cost basis with added, provable capital improvements; or

- DEFER or ELIMINATE. With carefully customized legal & tax documentation, there are ways to facilitate tax deferral (not avoidance) or eliminate the tax on Capital Gains portion of NET sales proceeds.

As an example of DEFERRAL, IRC § 453 can be used to sell your home on an installment basis that defers capital gains taxes either on an incremental basis or to a future balloon payment. The positive impacts of spreading tax on some of the NET sales proceeds into future years cannot be overstated. Invoking this solution can materially affect your cash flow, and what health & government programs you might qualify for.

As an example of ELIMINATION, a charitable trust charitable trust is an irrevocable trust that may be set up during life or at death if you wish to leave all or some portion of your estate to charity. These trusts are used for philanthropic reasons as well as to obtain certain tax advantages. There are two specific types of charitable trusts: a charitable remainder trust and a charitable lead trust, often known as a “split interest” trust. may be an ideal tax-savings option for those that wish to make a substantial gift to charity. It can also operate as a remainder trust—set up to provide an income stream to a trust beneficiary (often you or your spouse) during the term of the trust, which is typically a fixed period, or the life of the named beneficiary. At the end of the trust term, the trust terminates, and the remainder of the trust value passes to specific chosen charities.

Taken together, these are many of the key factors affecting whether you decide to sell your home and, if so, the consequences.

While property value is vital, it is only one of many quantifying pivots in your decision making. There is much more to the process.

By engaging me as your real estate professional, you avail yourself to legal and tax advice throughout the sales transaction when it is vitally important. I stay personally involved as your real estate professional (typically as [co-] listing Broker and as your Attorney) throughout all activities from start to finish and directly participate in the process of maximizing NET sales proceeds while mitigating legal / tax liabilities. I coordinate the TEAM effort, maintaining open and frequent communications right up to escrow closing and even beyond.

To advance your thoughts, at no charge, we will confidentially gather key data in order to discuss your goals, timing, and property value that may lead to a consultation with our tax estate planning attorney (LL.M.) partners who will present you with several often more complex but useful alternatives. They will then draft tax estate planning that serve your needs.

Given these options, the smart move is to capitalize on the current market, maximize NET sales proceeds, and invest / grow the amount of money you would otherwise pay in taxes by deferring or eliminating the CAP GAINS tax. Ours are viable strategies that are customized to your specific needs and cash flow requirements. It absolutely makes good sense to discuss these matters.

My compensation comes from fulfilling my role as your [co-] listing Broker and is contingent upon escrow closing. If not engaged as your [co-] listing Broker, my role is solely as your real estate Attorney acting pursuant to a written representation agreement.

Both ways, we’ll discuss property value, timing, the economy, trends, tax estate planning, cash flow, retirement aspirations, and implementation of strategies.

Mine is a common sense, balanced, & communicative approach. With 35+ years expertise in real estate brokerage, law, estate planning, and tax, I will help you make informed and positive decisions!