Which of the Following Apply to YOU?

- You have owned your property since before 2009,

- The appreciated part of your home equity exceeds $250,000 / $500,000,

- You want/need to address your Capital Gains tax concern,

- The size/amenities of your property exceed your needs,

- You are interested in ‘right-sizing‘ home ownership,

- It has been years since you last bought/sold real estate,

- Your age is ≥55+ years,

- Future financial security & cash flow means a lot to you,

- You are receptive to a no obligation conversation about options.

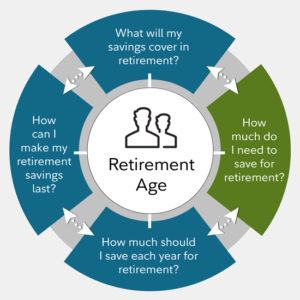

Related: How much do I need to retire?

With Market Changes, What are Your Plans?

- What are you doing to maximize your position?

- What is the REAL value of your home .. not just in the neighborhood, but to YOU?

- How do Capital Gains fit into your decision to stay or sell?

- Tips on whether you should eliminate that mortgage in retirement.

NOW is the time to engage in a meaningful conversation to assess your options.

More Inventory Coming, But Who Will Buy

Aging In Place

Nearly everyone would prefer to age in place as they grow older. But often, the spacious family home becomes too burdensome, financially and physically, to maintain for many individuals over 55. Careful assessment of the various impactful pivot points is vital to making informed decisions.

In fact, aging in place is becoming an increasingly difficult goal particularly in California.

If you are approaching or 55, spend a few moments reading the following: » JCHS » Harvard University Report

More than half of the nation’s households are now headed by someone at least 50+ years of age. These 65 million older households are highly diverse requiring different types of housing to meet their needs and preferences. Affordable, accessible housing located in age-friendly communities and linked to health supports is particularly in short supply. And whether they own or rent millions of older households struggle to pay for their housing, health care, & other basic daily necessities.

Determining Next Steps.

Deciding When to Sell.

The decision for some might be simple. However, your ‘next’ steps might involve a complex set of decisions relating to estate & tax planning, finances, legal matters, real property requirements & concerns, down/right-sizing strategies, logistics of timing, and (importantly) possibly involving family and loved ones not to mention your tax and legal professionals.

This is where my TEAM of local top producing real estate professionals and I step in to assess your best options that often begins with real property value assessment to estimate the amount of your equity as this determination bears on what you can do with NET escrow proceeds, whether there is a capital gains concern, and more.

What If You Default on Your Mortgage?

Sadly, a growing trend involves property foreclosures in the 50+ age group where there is positive equity – that is, where the loan / mortgage debt is less than the fair market value of the property.

Refinance options are limited because lenders generally look to sufficient ‘active’ employment income that may be unavailable if you are retiring / retired, lenders usually won’t consider retirement income from 401Ks, IRAs, or pension plans. That said, there are some restricted refinance programs (created by Freddie Mac and Fannie Mae) that you might work for you depending on numerous criteria.

Refinance options are limited because lenders generally look to sufficient ‘active’ employment income that may be unavailable if you are retiring / retired, lenders usually won’t consider retirement income from 401Ks, IRAs, or pension plans. That said, there are some restricted refinance programs (created by Freddie Mac and Fannie Mae) that you might work for you depending on numerous criteria.

Selling your property may be your only or best choice to avoid an involuntary loss of ownership. But let us take a look so we can assess and advise.

We Are Uniquely Qualified

Credentials include:

- Senior Real Estate Specialist designation,

- Attorney licensed in CA & CO,

- Independent Realtor-Broker licensed in CA & CO.

- Team comprised of top-producing local Realtors and me.

We address the big picture decisions that often begins with a real property valuation to estimate your NET equity disbursement from a sale as this number affects needed money for relocation / repurchase, capital gains tax concerns, collateral investments, and more.

We are particularly active in these geographic areas:

- – CA Counties: Santa Barbara, Ventura, Los Angeles « Link

- – CO Counties: Denver, Douglas, Jefferson, Adams, Arapahoe « Link

The SRES® designation (what is SRES) enables me to to review your current housing situation and outline the topics to weigh as you consider your next move. My team will provide pertinent information on housing trends, financing and market conditions.

We are real estate & legal experts /advisors who will help you with the vital considerations required to determine the very best next place to call home.

You will find our team approach to be friendly, professional, very focused, streamlined, and highly communicative all in order to foster informed decision-making that instills knowledge, confidence & peace of mind.

Reasons To Engage Me as Your Specialist

- I stay personally involved in your transaction, from start to finish

- There is no one between us; you receive 100% personal attention

- “Plain speak” that helps you make informed decisions

- Prompt, precise communications

- 30+ Years Seasoned Specialization

- Broker-Realtor & Attorney licensure

- NO HOURLY FEES where I am listing Realtor-Broker

- I UNDERSTAND real estate from the inside out

- 100s of representations – property values exceeding $350,000,000

- Legal, Real Estate, Tax, Practical advice giving

- TEAM representation with best local Realtor partners

- Most importantly, I take you seriously

In the end, I provide relief, solutions, and peace of mind. I am a highly communicative professional, your advocate, very knowledgeable in real estate and business matters (in particular) and other concerns too. If I cannot assist you, I will aim you toward professionals who can.

Other Loan Considerations Finance of America Mortgage