Building a Bridge

Ensuring that your equity is protected

Ensuring that your equity is protected

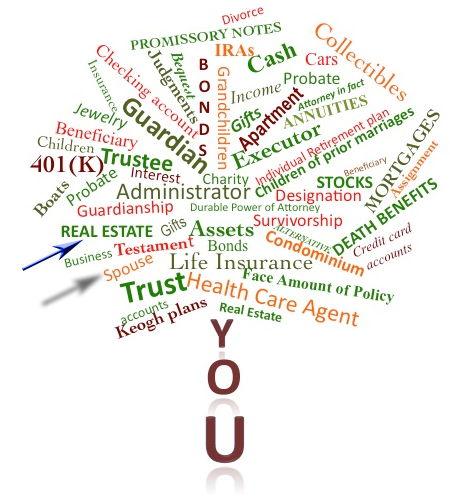

Developing a plan for your estate necessarily includes all aspects of your finances & real property interests. That’s where I can assist.

Real estate is often a major component of most individuals’ estates. My team is well-equipped to address the disposition of your home and other real property (i.e., commercial) ownership interests & goals. Whether it is a matter of right-sizing (up or down), or correcting vesting to protect invested equity (i.e., to a Trust), or contending with other ownership options, we can assist.

Working collaboratively with your tax & financial advisers, I draft estate planning to reflect your legacy wishes particularly as it relates to the disposition of your real estate interests &/or proceeds from the eventual sale of it.

Establishing your real estate objectives in your estate planning ensures that your hard work to pay off the mortgage will result in the desired use and distribution of equity.

Email or call me to discuss your real estate ownership/s, estate planning documentation, and more. I can help you craft 5 Most Important Estate Planning Documents documents that fit your needs including:

- Will (Pour-Over)

- Revocable Living Trust + Deed Transfer (+ Recording Fees)

- Durable Powers of Attorney for Financial Management

- Advance Health Care Directives

- HIPAA Medical Release Forms

- Funding Instructions

- ** Pet Protection Agreement

- Personal Organizer

Call for a FREE & CONFIDENTIAL consultation. Let’s discuss options, pricing & timing.